BTC Price Prediction: Path to $200,000 Amid Technical Strength and Market Uncertainty

#BTC

- Technical indicators show BTC trading above key moving averages with bullish momentum

- Institutional adoption is accelerating through major partnerships and growing interest

- Macroeconomic factors including CPI data and potential Fed rate cuts could significantly impact price movement

BTC Price Prediction

Technical Analysis: BTC Shows Bullish Momentum Above Key Moving Averages

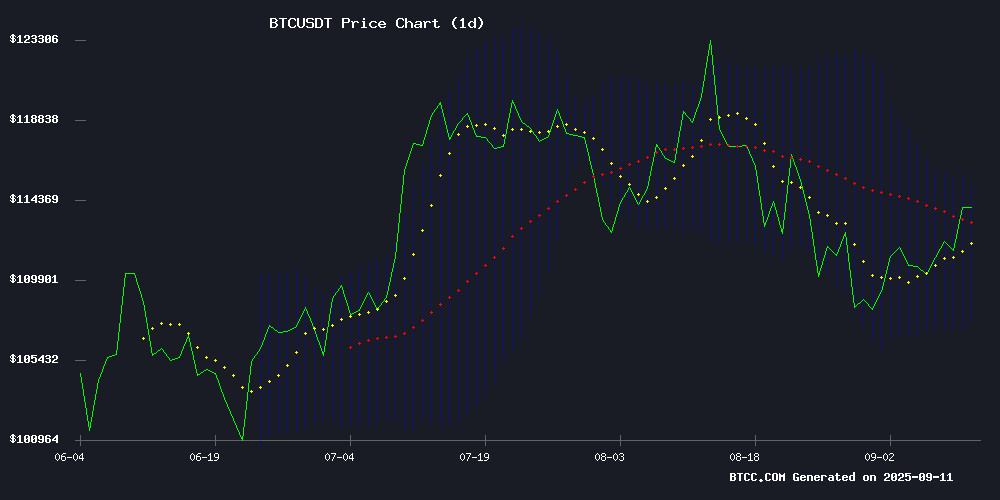

BTC is currently trading at $113,964.55, comfortably above its 20-day moving average of $111,325.57, indicating sustained bullish momentum. The MACD reading of -1,204.81 suggests some near-term consolidation, but the price holding above the middle Bollinger Band at $111,325.57 demonstrates underlying strength. According to BTCC financial analyst Robert, 'The technical setup supports continued upward movement, with the next major resistance around the $115,000 level represented by the upper Bollinger Band.'

Market Sentiment: Mixed Signals Amid Institutional Adoption and Macro Concerns

Market sentiment presents a complex picture with both bullish and cautionary signals. Positive developments include Binance's partnership with Franklin Templeton for tokenization and JPMorgan reporting accelerating institutional adoption. However, warnings from Doctor Profit about a potential 2026 market crash and S&P 500 uncertainty create headwinds. BTCC financial analyst Robert notes, 'While institutional momentum is building, traders should monitor today's CPI data release closely as it could trigger significant volatility in either direction.'

Factors Influencing BTC's Price

Doctor Profit Warns of 2026 Market Crash, Reveals Key Bitcoin Price Levels

Global economic indicators are flashing red as traders and analysts brace for potential turbulence. The crypto market, particularly Bitcoin, faces heightened volatility amid growing recession fears. Doctor Profit warns of a macroeconomic crisis, pointing to the inverted yield curve—a historically reliable recession predictor—which recently normalized after a record 784-day inversion.

Bitcoin's price target of $90K–$94K remains intact regardless of whether the crash hits in coming weeks or by mid-2026. The current cycle diverges from historical patterns with its prolonged inversion period, while rising unemployment and downward job growth revisions add to the unease. This normalization phase typically precedes recessions, as seen in 1990, 2001, and 2007.

Strategy Escapes Another Shareholder Lawsuit Over Accounting Issues

Bitcoin treasury giant Strategy has secured another legal victory as a shareholder lawsuit was dismissed by the court. The case, filed in June by Abhey Parmar and Zhenqiu Chen, alleged breaches of fiduciary duty and gross mismanagement. This follows a similar dismissal in May, highlighting a pattern of legal challenges faced by the company.

Strategy, formerly MicroStrategy, remains the world's largest corporate holder of Bitcoin with 638,460 coins valued at approximately $72.5 billion. The company has pivoted from its original data analysis software business to focus exclusively on Bitcoin accumulation. Its Nasdaq-listed stock (MSTR) has surged 3026.92% since its first Bitcoin purchase in 2020.

Co-founder Michael Saylor's aggressive Bitcoin acquisition strategy continues to draw both admiration and scrutiny. The company's regulatory history includes a 2000 settlement with the SEC over accounting irregularities, though it admitted no wrongdoing.

Bitcoin Shows Bullish Signals Amid S&P 500 Uncertainty

Bitcoin is exhibiting a classic inverse head-and-shoulders pattern, a technical indicator often preceding bullish momentum. The cryptocurrency's upward trajectory contrasts with growing caution in traditional markets, where the S&P 500's rising wedge formation suggests potential downside.

Equity market weakness could spill over into digital assets. S&P 500 E-mini futures have reached record highs, but momentum appears to be fading. A confirmed breakdown from the current pattern may trigger broader market retreat.

Inflation data looms as a critical catalyst. An elevated CPI reading could exacerbate existing market jitters, potentially pressuring both equities and cryptocurrencies. The specter of stagflation adds complexity to the macroeconomic backdrop.

US CPI Data Release Today: Will Bitcoin Price Explode or Crash?

The U.S. Consumer Price Index (CPI) report, set for release at 8:30 a.m. ET, has markets on edge. Wall Street anticipates a 2.9% inflation rate, with traders bracing for volatility across stocks and cryptocurrencies, particularly Bitcoin (BTC) and altcoins.

Analysts project a 0.3% monthly rise in CPI, pushing the annual rate to 2.9% from July's 2.7%. A reading at or above consensus could trigger a market pullback, signaling persistent inflationary pressures. Conversely, a surprise downside—fueled by yesterday's softer Producer Price Index (PPI) data—might revive hopes for a 50 bps Fed rate cut in September.

Diverging views from major banks add to the uncertainty. Goldman Sachs warns of potential new highs in August inflation, while Bank of America aligns with the 2.9% consensus. The Federal Reserve's data-dependent stance means today's figures will heavily influence its rate-cut trajectory.

Bitcoin remains hypersensitive to macroeconomic shifts. Its price action today could hinge on whether CPI confirms or contradicts the PPI's dovish signal.

GetBit CEO Abhay Agarwal: Bitcoin Is 'More Money Than Tech'

Bitcoin's evolution from a technological experiment to a monetary asset is now undeniable, according to GetBit CEO Abhay Agarwal. In an exclusive interview with Coinpedia, Agarwal emphasized Bitcoin's role as 'digital Gold' rather than a software token. Its decentralized governance, capped supply of 21 million coins, and resistance to inflationary pressures set it apart from other digital assets.

Unlike tokens governed by corporate entities or foundations, Bitcoin operates without centralized control. This scarcity and decentralization mirror traditional monetary assets, reinforcing its value proposition. Agarwal noted, 'Its computing power, global reach, and role as a hedge against monetary inflation make it fundamentally different.'

Regulatory clarity is further accelerating institutional adoption. Investors increasingly view Bitcoin as a hedge amid macroeconomic uncertainty, with its fixed supply offering a predictable alternative to fiat currencies.

Binance Partners With Franklin Templeton for Tokenization Push

Binance, the world's largest cryptocurrency exchange, has entered a strategic partnership with Franklin Templeton, a $1.6 trillion asset manager, to explore the tokenization of securities. The collaboration aims to merge Franklin Templeton's compliance expertise with Binance's global trading infrastructure, paving the way for new security tokenization products set to launch later this year.

Franklin Templeton, which manages $1.64 trillion in assets, was among the early issuers of Bitcoin ETFs in the U.S. This partnership underscores the growing convergence between traditional finance and the crypto industry, as institutional players increasingly embrace digital asset innovation.

The initiative seeks to develop tailored digital asset solutions for a broad range of investors, further bridging the gap between traditional and decentralized finance. Roger Bayston, Franklin Templeton's head of digital assets, highlighted the potential for tokenization to enhance accessibility and efficiency in financial markets.

JPMorgan Reports Institutional Crypto Adoption Gaining Momentum

Institutional adoption of cryptocurrencies remains in its early stages but is building significant momentum, according to a JPMorgan report released Wednesday. The analysis highlights growing participation from sophisticated investors, with institutions now holding roughly 25% of Bitcoin exchange-traded products.

Market data reveals accelerating institutional interest across multiple fronts. The Chicago Mercantile Exchange recorded record-high open interest in crypto derivatives, while an EY survey found 85% of firms either already allocated to digital assets or plan to by 2025. Regulatory developments, including Bullish's August IPO and the GENIUS Act passage, have removed barriers that previously deterred large investors.

Bullish shares have surged 45% since its debut, currently trading at $54.50—above JPMorgan's $50 price target. The bank's analysis suggests this institutional momentum reflects a structural shift rather than temporary speculation, with Bitcoin serving as the primary beneficiary of increased allocations.

Bitcoin Bulls Warned as South Korean Kospi Rally Threatens BTC's Bull Run

South Korea's benchmark Kospi index surged to a record high of 4,340 points, fueled by shareholder-friendly policies and robust global market sentiment. The rally has sparked caution among Bitcoin investors, with analysts noting a historical correlation between Kospi peaks and BTC market tops.

"Every Kospi record high has coincided with Bitcoin trading near cycle highs," observed crypto analytics platform Alphractal. The pattern held in 2021 when BTC peaked at $70,000 just as Kospi reached its zenith, preceding a year-long crypto winter. Similar parallels emerged during 2017's bull market and mid-2011 interim tops.

While not definitive, the relationship underscores how both assets respond to global risk appetite. Capital typically flows into export-driven emerging market equities like Kospi and speculative assets like Bitcoin during risk-on environments—until sentiment shifts.

S&P 500 Rejection of Strategy Deals Blow to Crypto Treasury Sector

The S&P 500 index committee's rejection of Strategy—formerly MicroStrategy—marks a pivotal moment for crypto treasury firms. Despite meeting technical criteria, the company's exclusion signals growing institutional skepticism toward businesses built around large Bitcoin holdings.

JPMorgan analysts interpret this as a sector-wide warning. Index membership had been a key driver for Strategy's stock performance, with prior inclusions in the Nasdaq 100 and MSCI indices providing critical exposure. The discretionary rejection suggests other index providers may follow suit.

Regulatory headwinds are mounting. Nasdaq now requires shareholder approval for companies with crypto holdings before issuing new shares. Meanwhile, investor appetite wanes as crypto treasury models show declining performance—a trend that could accelerate if benchmark indices continue excluding such firms.

Bitcoin Technical Analysis Suggests Potential Breakout Toward $150K Amid Fed Rate Cut Speculation

Bitcoin's price action reveals a compelling technical setup as it consolidates within an ascending symmetrical triangle. The pattern's measured move suggests potential upside targets ranging from $123,731 to $150,309, with Bollinger Band width indicating the most significant monthly volatility potential since 2009.

Political developments are adding macroeconomic tailwinds, with former President Trump advocating for aggressive Federal Reserve easing. The proposed 100 basis point rate cut could further fuel cryptocurrency demand as investors seek inflation-resistant assets.

Institutional interest continues to grow, highlighted by Metaplanet's $1.4 billion Bitcoin acquisition plan. The resurgence of ETF inflows provides additional confirmation of renewed institutional participation in the digital asset space.

Longer-term chart patterns remain constructive, with the monthly timeframe displaying a cup-and-handle formation that projects toward $305,000 by 2025-2026. Current price action near the $112,236 level shows Bitcoin testing key Fibonacci resistance at $117,156, while maintaining support above $107,304.

Trump Ally and Bitcoin Advocate Charlie Kirk Killed in Utah Shooting

Charlie Kirk, a prominent conservative activist and vocal Bitcoin proponent, was fatally shot at Utah Valley University. The 31-year-old political figure had recently gained attention in the crypto space for his advocacy of a U.S. Bitcoin reserve funded by tariff revenue.

Kirk's bullish Bitcoin stance placed him alongside institutional advocates like Michael Saylor. He frequently predicted a $1 million price target, citing Bitcoin's scarcity and irreversible adoption curve. "Bitcoin is more likely to go to a million than to zero," Kirk declared during a recent podcast appearance, drawing parallels between crypto adoption and the global dominance of English.

The tragedy removes a unique political voice that bridged conservative circles and cryptocurrency advocacy. Kirk had proposed using tariffs to build a national Bitcoin treasury - a controversial idea that gained traction among some fiscal conservatives.

Will BTC Price Hit 200000?

Based on current technical indicators and market developments, reaching $200,000 is plausible but requires specific conditions. The current price of $113,964 represents approximately 75% growth needed to achieve this target. Key factors that could drive this movement include sustained institutional adoption, favorable regulatory developments, and continued macroeconomic uncertainty driving demand for Bitcoin as a store of value.

| Current Price | Target Price | Required Growth | Timeframe Estimate |

|---|---|---|---|

| $113,964 | $200,000 | 75.5% | 12-18 months |

BTCC financial analyst Robert suggests that while the technical foundation is strong, investors should maintain realistic expectations and monitor macroeconomic indicators closely.